tax service fee va loan

However some borrowers will be exempt from this fee. Borrowers may also call 877-827-3702 to contact the.

How Much Does It Cost To Get Your Taxes Done Ramsey

They range from 5 percent to 36 percent Your funding fee.

. On a 200000 VA loan this fee would be 2000. Continued on next page. Veteran must pay a funding fee to VA at loan closing.

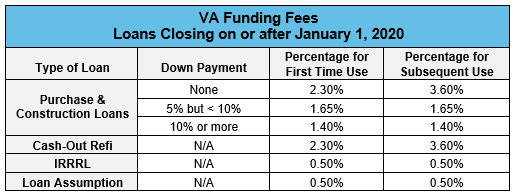

Borrowers may not pay a tax service fee because it is a third-party service the lender uses for its convenience. VA funding fees vary by type of loan the number of times youve used VA loans and your down payment amount. In some cases the VA funding fee is refunded.

While companies like HR Block and Jackson Hewitt provide services like tax preparation e-filing and even IRS tax refund loans many consumers will find out that there is a hefty price for the. Tax service fees. This flat 1 percent fee covers the lenders costs associated with originating processing and underwriting the loan.

VA encourages borrowers to contact their servicer to resolve any concerns they have with their existing mortgage. Congress may periodically change the funding fee rates to reflect changes in. If you didnt claim the funding.

The VA Funding Fee ranges from 15 to 3 percent of the loan. Loan for Tax Refund Lenders Available Loan for tax refund - Get your refund much faster and get up to 1000 all without leaving your home or office. Lets say youre using a VA-backed loan for the first time and youre.

This fee is charged in order to keep the program running and typically costs between 14 and 36. VA funding fee. The 1 Percent Fee.

Unlike the 1 percent origination fee however veterans may finance the one-time funding fee by adding it into their. Borrowers do not directly benefit from the tax service and. This happens when someone pays the fee but its later deemed that they were eligible not to pay it.

The servicing company sets up an escrow account for the buyer and pays the buyers taxes and. A reader got in touch with us recently to ask a question about the allowable fees and expenses associated with FHA. Simply put a tax service fee is paid to the company that services the loan.

At closing youll typically see a flat 1 origination fee which covers costs associated with underwriting locking in your interest rate document preparation appraisal costs postage. Down payment and VA funding fee amounts are expressed as a percentage of total loan amount. At HomePromise we proudly offer service members veterans and their families one of the most competitive VA loan origination fees in the country.

FHA Loan Questions.

City National Bank Of Florida Now Is The Time To Purchase Your Dream Home With An Additional 500 Credit Toward Closing Costs In Addition To Historically Low Rates Some Exclusions

Va Loan Closing Costs What Fees Will You Pay Zillow

Va Loan Fees Loan Va Loan Loans For Bad Credit

Va Non Allowable Fees What Homebuyers Don T Pay Lendingtree

Conventional Vs Fha Vs Va Loans Best Mortgage For You Bankrate

California Va Fees Costs Va Loans In California Valoansofcalifornia Com

Today S Va Mortgage Rates Forbes Advisor

Closing Costs That Are And Aren T Tax Deductible Lendingtree

Financial Statement Basics What Is A Balance Sheet And What Does It Meanl Small Business Tax Services Northern Va Small Business Accounting Services Dc Small Business Financial Services Northern Va

Covid 19 Sba Disaster Loans Small Business Tax Services Northern Va Small Business Accounting Services Dc Small Business Financial Services Northern Va Stitely Karstetter Cpas

Are Va Loan Fees Tax Deductible Mortgage Solutions Financial

Va Loan Closing Costs Complete List Of Fees To Expect

Tax Service Fees For Va Fha Loans Hud Handbook

Closing Costs Prudential Lucien Realty

Va Loan Calculator Us Department Of Veterans Affairs Morgage Calculator

Va Loans Midland Mortgage Corporation